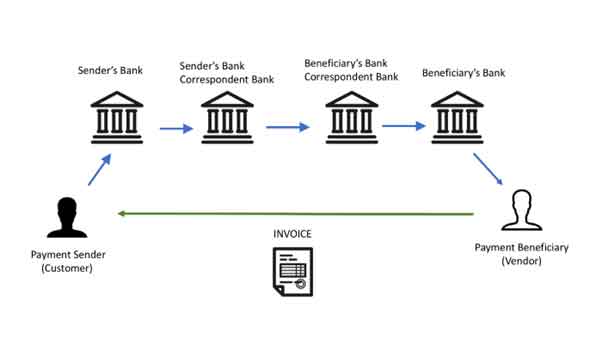

Most domestic bank transactions are processed immediately or at least in an hour or two, but that is not the case with cross-border payments. Cross-border payments are much slower and more frustrating, causing disruptions in business processing, strain in business relations and increased transaction costs. Cross-border payments can take up to weeks for the transfer, …