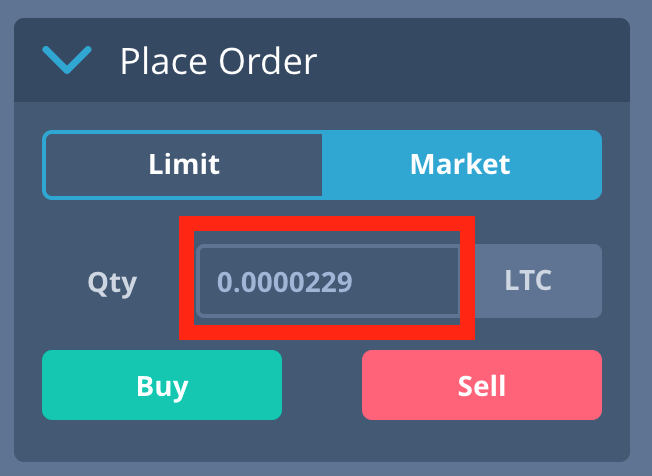

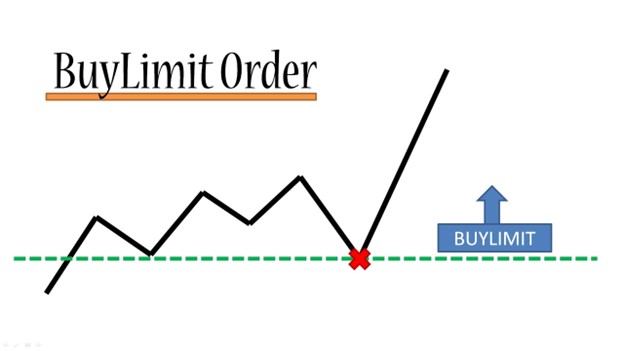

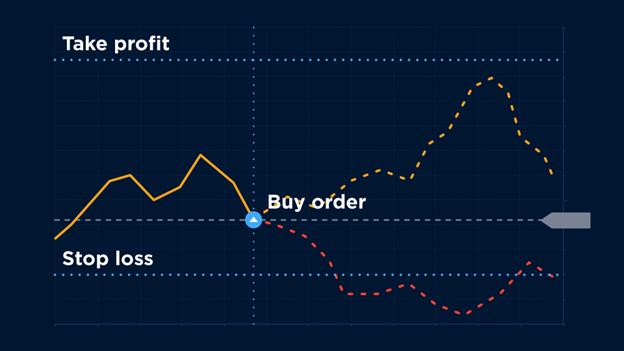

‘Order’ plays a pivotal role in currency trading as it acts as a means by which traders interact with the market, expressing their intentions on how trades should be executed. Orders are instructions given by traders to a broker or trading platform to execute a trade at a specified price or under certain conditions, which …